-

Latest Posts

- Shaping Tomorrow: The Bright Future of Indian Startups in 2023 and Beyond

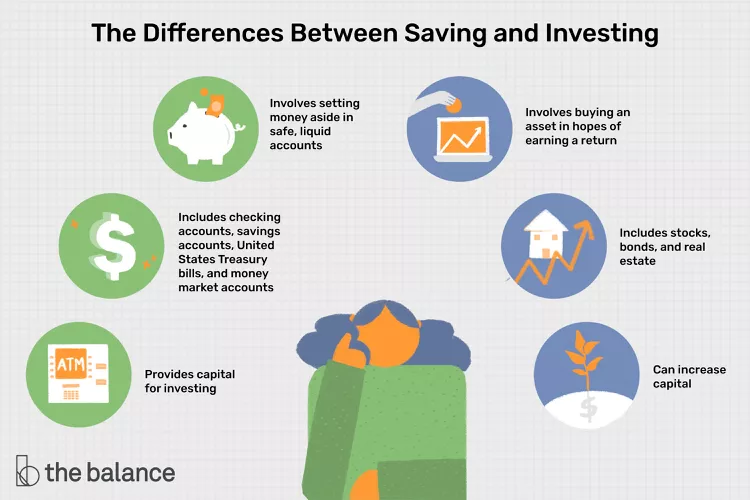

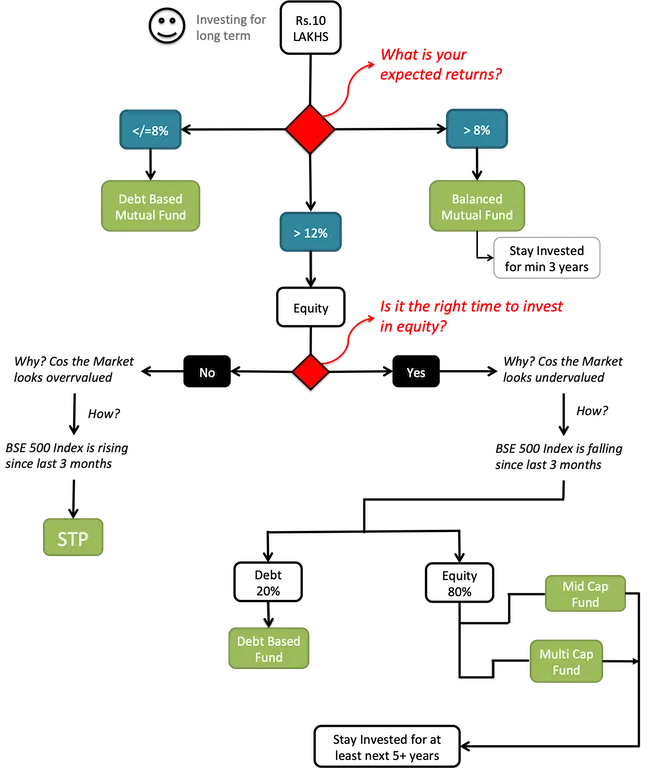

- Investing Vs. Saving – The 5 Ways Indians are Achieving Financial Stability

- Unicorn Startups – The 33 Remarkable Companies

that Started with Little or No Funds – A Case Study - Startup Founders and Entrepreneurs – The Differences are Actually Amazing Yet Simple

- 4 Pillars of Scalable Startup Entrepreneurship

-

Follow us on Social Media

-

Archives